News & Media

Baker McKenzie signs on to Mirvac’s 55 Pitt Street

Mirvac and Mitsui Fudosan Australia have secured major tenants at 55 Pitt Street, with Baker McKenzie committing to the premium-grade office tower overlooking Circular Quay, lifting precommitments to ~40% alongside MinterEllison, as the building’s core construction pushes past level 40.

New Mirvac wellness program targets office engagement and attendance

Mirvac has launched a wellness program across eight of its commercial buildings nationally to deliver complimentary health and wellbeing activities to a potential ~27,000 customers and their employees. The program follows the success of a six-month pilot program at four of its Sydney commercial buildings, with more than 75 per cent of participants stating that the program positively influenced their decision to come to the office.

Congratulations to the 2026 Pinnacle Foundation scholar cohort

Mirvac is proud to continue its partnership with the Pinnacle Foundation for a third consecutive year, supporting three scholars as they progress through their tertiary studies in property, construction, and related fields.

Heritage Lanes Cuts Cup Waste Through New Circular Reuse System

Mirvac and M&G Real Estate, the real estate investment arm of M&G Investments, have announced that Heritage Lanes at 80 Ann Street, Brisbane, has achieved a 6 Star NABERS Energy rating – the highest possible rating for energy performance in commercial buildings.

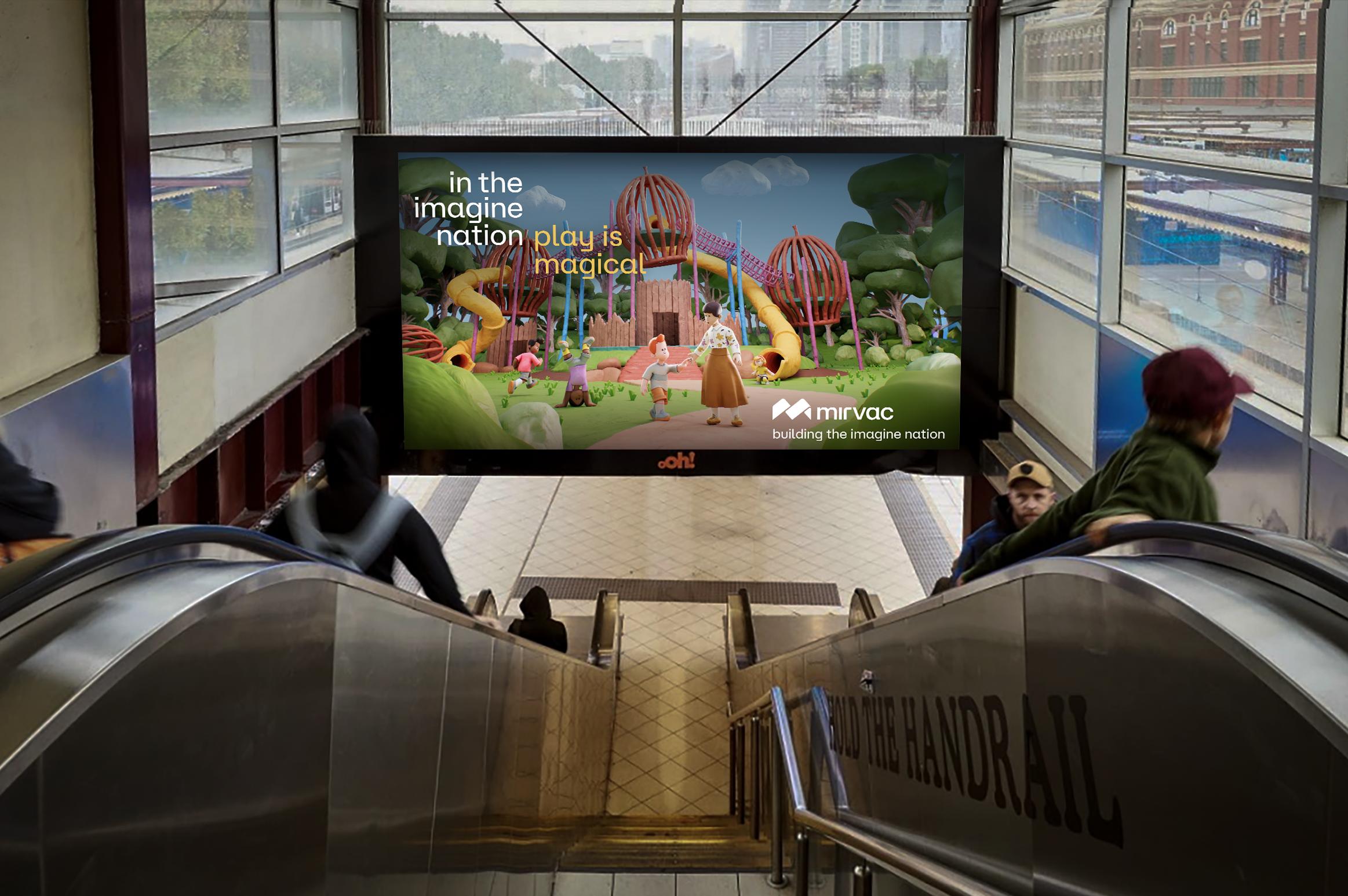

Mirvac launches first integrated brand campaign: building the imagine nation

Mirvac has launched its first integrated brand campaign in the company’s 54-year history, revealing a new brand platform – building the imagine nation, celebrating its role in shaping Australian places and communities.

Heritage Lanes Cuts Cup Waste Through New Circular Reuse System

Heritage Lanes at 80 Ann St in Brisbane has diverted more than 119,000 disposable cups from landfill in less than 12 months through an innovative reusable cup program, complete with a selfservice kiosk built using more than 125kg of recycled bottle caps collected onsite.

Mirvac and Pulpmaster: Turning Organic Waste into Opportunity

Mirvac continues to partner with Pulpmaster to convert food waste into a useful product to reduce the amount of waste sent to landfill.

Mirvac and Social Traders Launch Third Round of Supplier Development Program

Mirvac is proud to announce the third round of its Supplier Development Program, delivered in partnership with Social Traders.

Sydney Metro announces partners for Hunter Street Station precinct

Sydney Metro has today announced the appointment of Lendlease, Mirvac and Coombes Property Group as development and delivery partners for the new Hunter Street metro precinct, marking another significant step forward in the delivery of Sydney Metro West.

NAB commits to 700 Bourke Street in landmark lease renewal

National Australia Bank (NAB) has renewed its lease at 700 Bourke Street, Melbourne, an iconic office building within the ~$6 billion Mirvac Wholesale Office Fund (MWOF), committing to the building until 2038. This agreement covers the entire building, approx. 63,000sqm and represents the single largest leasing transaction in the Australian office market in 2025.

Building connections: Our holiday edition

We’re pleased to bring you our next edition of Building Connections, our stakeholder newsletter. A picture tells a thousand words, so we invite you to take a quick look at some of the great things we’ve been able to achieve together this year.

Mirvac acknowledges Aboriginal and Torres Strait Islander peoples as the Traditional Owners of the lands and waters of Australia, and we offer our respect to their Elders past and present.

Artwork: ‘Reimagining Country’, created by Riki Salam (Mualgal, Kaurareg, Kuku Yalanji) of We are 27 Creative.